Credit card rewards, cash back, airline miles, and the likes were major gimmicks banks used to attract us to using credit cards more; and it worked! We sign up for cards now with the best reward without a care for what the interest rates are (upwards of 25%!), we brag about what we got with our rewards, and we spend more on our cards all the while getting that 1-3% back in rewards on that spending.

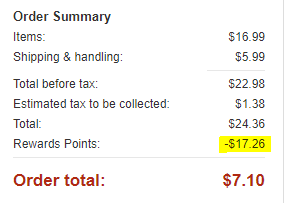

I’ve been using reward credit cards since I was 18 and I try to maximize the amount I’m getting back with them without spending more. What I have found with credit card rewards is that you SHOULD NOT be claiming the points for purchases, miles, or gift cards UNLESS the value of the reward received is greater than what you could claim the points for in cash. So for example, if you use $25 worth of your points on Amazon.com to purchase a $25 item, you would have spent $25 worth of your points but spent nothing out of pocket. This isn’t worth it! If you get a $150 plane ticket as a reward for $145 worth of points or less, this is worth it! I’ll dive deeper into the why later.

So How Does Pay with Points Work?

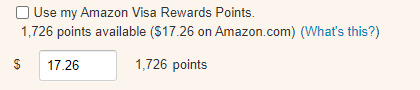

Amazon was an early adopter of Pay with Points when they teamed up with Chase; now they support many other card rewards. Paypal has even started supporting pay with points. How it works is that during checkout when you’re selecting a payment option, supported credit cards will give you the option to “Use my Rewards Points” and then prompt for how many points you want to apply. You can use some points, your max points, or enough to make the item free; up to you.

How Should I Use My Points?

Like I said, most of the time you should just take the statement credit or cash back. This maximizes the rewards you’re getting. Going back to the Amazon purchase of $25, if you use your reward points, you spent $25 in rewards for your item; you come out even. This is because the purchase is never charged to your card, so you don’t earn points. The bank will pay Amazon on your behalf so they save on paying you more rewards and Amazon is just making it easier for you to buy stuff.

Now consider, you charged that $25 onto your card and used a statement credit reward instead, you would receive 1-3% on that purchase in points. This would give you another $0.25 – $0.75 in rewards which is better than breaking even. These are small but add up across all the purchases you make. You only win with “pay with points” through convenience, but aren’t credit cards convenient enough?

Most banks will have the option of “Cash Back” in their reward centers. They will typically give you options such as a statement credit, ACH transfer (direct deposit to your bank), or even mailing you a check. All of these offer the same benefit unless they charge a fee. I typically use statement credit but have done ACH transfers before.

Are There Exceptions?

There are always exceptions to the rules. In this case, as I mentioned, use your points to claim rewards at a discount. It’s better if the discount is greater than the percent back you would get. An example here is that the Quicken World MasterCard has teamed up with Quicken that in the reward shop you can trade points for a year license. The normal cost of Quicken Home & Business for a year is $103.99 however you can use points to claim it for $85; a whole $18.99 in savings where you would only get $1.04 in rewards. This is where it is worth it to not claim the cash, especially if it’s for stuff you’re already going to purchase.

I hope this was inciteful and gets you thinking about your use of reward points. Please leave us comments below on your thoughts or use cases and let’s discuss. If you struggle with spending too much on your credit card or feeling underwater in debt, don’t wait, schedule a financial coaching session with us today to change your life.

Leave A Comment

What’s happening in your mind about this post !

2 Comments

Amy M

December 29, 2020 at 6:38 am

I hadn’t thought of losing the extra cashback from my credit card company by “paying with points!” Thanks!

I had realized that if I “pay with points” and had linked to the online site with “Rakuten” (to earn extra cash back), then I was losing extra cashback from there…since the total purchase price shows up to Rakuten as already being lowered by my pay-with-points! (Do you recommend sites like Rakuten, or is the data they’re collecting on me – by me using their site – not worth it?!)

CJ Ziegler

December 29, 2020 at 9:28 am

Hi Amy,

It’s up to you about the data collection vs savings. You can look at it like having a store card anywhere. I personally use Honey to get coupons and cashback and they collect information on our purchases.

Thanks for the addition, cause any other sites that rely on the value of the purchase to earn cash back also seem to decrease, so you could be losing out quite a bit then.