At age 18, I decided to go to a university to study engineering with little understanding of the financial implications that may come with this large decision. I was cheered on and supported by my family who was willing to go 50/50 on helping me achieve my goals. Not many have that available and I know I was lucky my parents worked so hard in their lives to offer me that opportunity. However, on the day of graduation, I owed $84,964.45 with $51,074.45 being in private loans. I had a determination to rid myself of this debt burden and these are 7 steps I took to accomplish that goal.

Step 1: Understand What You Have

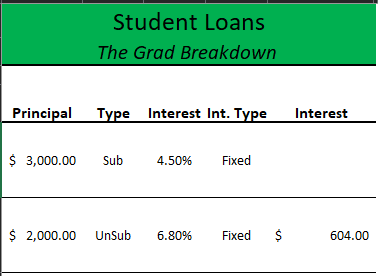

I can give you the dollar and cents of each loan, how much interest I had accrued all because I needed to know what I had so I could ultimately make a plan. With any debt problem, you need to understand your situation. I did this by making an excel worksheet, which would end up growing over the years but more on that later.

Something as simple as this was what I made. It told me how much I had, the type of loan, the interest rate, and how much interest I had accumulated. Once all the details were present, I could make my plan using a debt payoff method and figure out a timeline.

Step 2: Make a Plan & a Budget

I was very proactive in my senior year of college when it came to getting a job. Starting in September/October, I was sending out my resume when I knew I wouldn’t be starting until June or July. My eagerness allowed me to accept an offer in March which in turn gave me peace of mind my senior year that I had a job lined up. This also gave me what I needed to make a plan; what my income will be. I found and used this worksheet to build my planning budget mostly using rough numbers for expenses. When all was said and done, I can see how much money is leftover that I can throw at my student loans. My budget said I could throw 25% of my gross income at my loans. This is exactly what I did! and even made it upwards of 34% for some months. It’s what you have to do to get rid of such a large debt.

Step 3: Understand Plans Change

I had a plan coming out of college. On paper, it should work. Build up the emergency fund (I funded it to $5,000) and then focused on the debt problem. Let’s not be crazy, the 25% towards my loans was after the savings was built. Looking back, I could’ve easily done one to two thousand and put the other three to four towards the loans but I had security and peace of mind. My plan would equate to paying off my loans in 4.5 years! I could live with that. But a lot could happen in a year. I met my girlfriend six months after graduation, engaged a little over a year later, and married one year after that. Talk about throwing a curveball into plans. Understand that plans change and adapt. Know this though, debt is a chain on your legs, when the winds change, it’s harder for you to move with it the more debt you have. I had to adjust budgets, but I kept my perseverance about getting my student loans paid off. That meant cutting bills, staying in more, and being cheap here and there.

DEBT is a chain on your legs, when the winds change, it’s harder for you to move with it…

Step 4: Keep Yourself Motivated

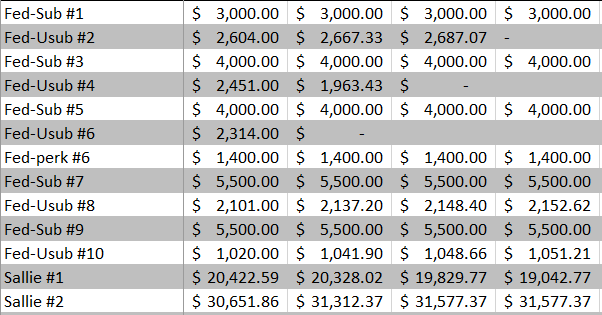

This part is key when it comes to a multi-year plan of eradicating your debt. If you go with the debt snowball method, it has a built-in reward system to help keep you going. However, this is not always the case and usually isn’t with the avalanche method. I chose the avalanche method. Luckily, in the beginning, my highest interest loans were some of the smallest. The quick wins lead me to upgrade my excel document to keep track of progress every time I paid off a loan. Each payoff, I would set the date and the current balance of every loan at that time. I built a burn-down chart from this data so I could watch my accomplishments as lines dropped to zero or larger ones decline.

If I wasn’t able to pay off any loans for a while (somewhere between 3-6 months) I would add a record to show the progress I did make. Other than the strong desire to pay off my loans, this helped me stay motivated to the cause and know I was making a dent. On top of tracking, I would make sure I shared my accomplishments with those supporting me to also keep the motivation train going.

Step 5: Increase Your Income

Dave Ramsey always says your biggest tool for building wealth is your income. Working towards increasing your income will expand your budget ultimately allowing you to then throw more at your debt. When I would get bonuses or tax refunds, I would send somewhere between 80-90% of it towards my student loans or debt. At raise time, I wouldn’t increase my spending but would increase my debt payments. This only shortens your time of paying as the interest or principal isn’t getting bigger, just the amount you can pay.

If you’re struggling, work to get a second job or even a third. I took the route of receiving more education while having my company pay for most of it. This is through tuition reimbursement and my team’s education budgets. I would work towards my masters all while studying for certifications. This would increase my worth as an employee with the hopes to increase the raise at the end of the year. Anything to get more money to rid ourselves of student debt.

Step 6: Use Every Option In Your Toolbelt

We have many financial tools available to us to help on our path to paying off our student loans. Budgets help maximize and control our use of our income. Increasing our income helps our budget and payments. Some more tools I want to talk about are the options we have with student loans. If you haven’t already, please read How Student Loans Work to understand what I did.

When I decided to go back to school for my masters, my loans were in their six month grace period. When I officially started, they went back to deferred status as my status moved to half time. This allowed me to pay whichever loans I wanted as it removed the required payments until I completed my degree. It also stopped interest accumulating on my subsidized loans.

The other tool I used was more student loans. Yes, more debt! When taking out student loans for school, you’re allowed to take out more than you need to cover additional expenses like housing, books, food, and more. I would take out new loans to pay for my school with a couple thousand more that I would then use to pay my other loans with. This would allow me to essentially refinance my old loans with lower interest ones. When my work would reimburse me after completing the course, I would use that too to pay off my loans.

Lastly, take any and all tax credits and deductions for your schooling that you qualify for. There is a student loan interest deduction that can be used on up to $2,500. There is also a lifetime learning credit for those going back to school, of up to $2,000.

Step 7: Time

Like most things in life, it takes time to pay off student loans. The more you pay towards them the less time it’ll take, but it still takes time. Keep your chin up and maintain hope that you can tackle this debt. Use various tools and friends to keep you on track and when it’s all over and paid for, CELEBRATE! It was, and will always be, a huge weight off my shoulders from paying off my loans and forever has ingrained financial management into my mindset, life, and being. The debt got me motivated, so go out and join the club of being student debt-free!