Tax season is like clockwork, it comes every year and all individual returns are due on the 15th day of April (US §6072-A) or to at least submit a request for an extension. Thousands of Americans get excited around this time as they expect to receive a couple hundred to a couple of thousand dollars back from the government in the form of a refund which might seem great, but this IS BAD!

Before I get into the why, let me tackle some myths that people believe.

| > When I owe fewer taxes the bigger my refund will be |

| The overall taxes you owe does not change. You’re not magically “beating” the government at their system; you just overpaid. |

| > Withholding more per paycheck is a great way to save |

| Giving the government an interest-free loan is no way to save. It would be better to set up an automatic transfer to savings on payday. |

| > My refund shrunk after the TCJA, so my taxes must have gone up! |

| Results may vary, but on the contrary, the IRS changed their withholding guidance so companies withheld less from your paycheck giving you more money per month and a lower refund. |

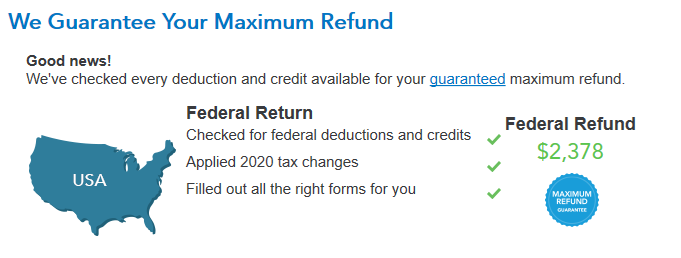

It’s definitely great seeing that large green number when filing but in reality, it’s not that great. From this example of a $2,378 refund, we could have had an additional $198/month in our pocket to spend on debt, investments, or savings. The refund is large because each paycheck your company withheld (taken out) more taxes than you owe. The government pays you 0% interest on these overpayments; it’s like having a 12 month, 0% interest, CD. If you would have withheld less, you would have more money throughout the year.

So Why Is This Bad?

What’s bad about this, as mentioned is that you’re locking away your money that you may need now or could use before tax season, and you’re getting nothing for it. This could cause you to incur more debt by not having the money in emergencies, or paying more interest from debts because you’re not paying more than you already are. It is recommended that when you get over $500 consistently every year as a tax refund, you will want to make a change to your withholdings.

What Can I Do About It?

Companies determine how much to withhold from your paycheck by your answers on the W4. Some people fill this out on day one on the job and never look at it again. Tax rules and regulations may change and this form should be refiled, but it is not required. You will want to update your W4 when tax rules change, your spouse starts a new job or stops working, or you have a child. The IRS also offers an online estimator to help you determine the values to put on the form based on your situation. You will then submit the updated W4 to your Human Resources or Payroll department at your employer and they will update their system accordingly. Start getting more of your hard-earned money today!

- Previous Post

- Next Post